A 2-day deep dive into how to generate monthly cash flow and long-term equity growth

Upcoming Event Dates

Where: Online – Join from Anywhere!

Go to Checkout

Here's What You’ll Learn:

Session 1: How to Control Property Without Owning It

Think you need a big deposit, a mortgage, or good credit to invest in property? Think again. Lease options allow you to control properties legally without buying them. In this session, you’ll discover how to use lease options to generate passive income and build equity without traditional financing.

Session 2: Finding and Working with Tenant Buyers

Tenant buyers aren’t like regular tenants they’re committed to eventually owning the property. That means fewer issues, on-time payments, and a more stable income stream for you. Learn how to attract the right tenant buyers, understand their mindset, and position your properties as the ideal solution.

Session 3: How to Find the Right Lease Option Deals

Not every property works for a lease option. Knowing how to spot high-potential deals is key. This session will show you how to filter properties based on demand, location, and financial viability ensuring every deal generates strong cash flow and long-term profits.

Session 4: Building Win-Win Partnerships with Landlords

Many landlords struggle with voids, maintenance, or problem tenants making them ideal candidates for lease options. Discover how to approach landlords, explain the benefits, and secure agreements that work for both of you. You’ll provide them with a hassle-free solution while profiting without ownership.

Session 5: Negotiating with Sellers for No-Money-Down Deals

Property owners often don’t realise that a lease option is their best solution. You’ll learn how to identify motivated sellers, handle objections, and structure agreements that benefit both parties. Get the exact negotiation scripts used by experienced investors to secure lease options with no upfront capital.

Session 6: How to Sell Lease Options for Maximum Profit

Session 7: Real-Life Case Studies Deals That Work

Theory is great, but real success stories are better. In this session, you’ll hear from investors who’ve built high cash flow portfolios with little to no upfront investment. They’ll share their exact deals, challenges, and strategies so you can apply them to your own journey.

Session 8: Exit Strategies for Maximum Profit

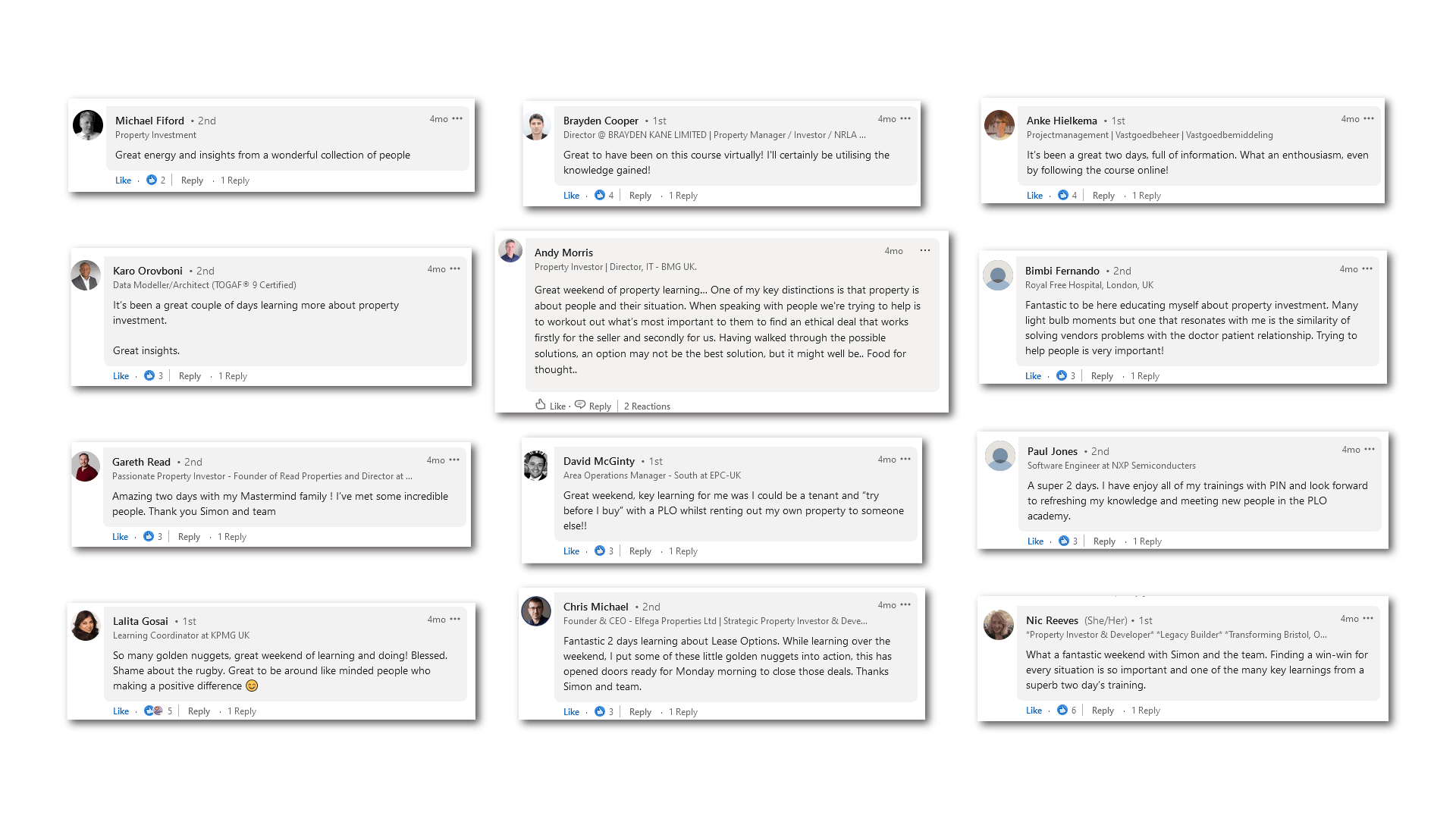

Here's what some of my students have experienced from this workshop...

Frequently Asked Questions

What exactly is a lease option?

A lease option is a property agreement that allows you to control a property, generate rental income, and have the right to buy it at a fixed price in the future—without needing a mortgage or deposit upfront. It’s a powerful strategy for investors looking to build cash flow without owning property outright.

Why should I consider lease options over traditional property investing?

Lease options allow you to profit from property without needing large amounts of capital or taking on mortgage debt. Unlike traditional buy-to-let investing, lease options give you greater flexibility, faster cash flow, and reduced financial risk, making them ideal for investors who want to grow their portfolio efficiently.

Are lease options suitable for beginner property investors?

Yes! Lease options are perfect for beginners because they don’t require large deposits, mortgage approvals, or extensive property experience. You’ll learn step-by-step how to find, negotiate, and structure deals at Lease Options Live, even if you’re new to property investing.

How do I find properties suitable for lease options?

Not all properties work for lease options, so it’s important to know how to filter the right deals. At Lease Options Live, you’ll discover where to find motivated sellers, how to assess property potential, and what to say when negotiating to secure the best deals.

Why would a property owner agree to a lease option?

Many property owners struggle to sell their property, deal with problem tenants, or keep up with maintenance. A lease option provides them with a guaranteed monthly income and a future buyer, without the hassle of traditional selling. It’s a win-win solution when structured correctly.

Where do lease options work?

Lease options are a powerful property investing strategy that can be used in many countries, but their legality and effectiveness depend on local property laws. They work particularly well in England and Wales, where property law allows for flexible agreements between buyers and sellers.

In the United States, Australia, and parts of Europe, lease options are also widely used, with variations in contract structures and regulations. However, in Scotland, lease options are not legally enforceable in the same way due to differences in property law. Investors looking to use creative strategies in Scotland may need to explore alternative approaches such as rent-to-rent, joint ventures, or delayed completion agreements.

At Lease Options Live, we cover how and where lease options work best, ensuring you have the right knowledge to apply this strategy legally and profitably in your chosen market.

How do I secure lease option deals with no money down?

Lease options allow you to control property with little to no upfront capital, but there are techniques to structure deals with minimal financial commitment. You’ll learn how to negotiate no-money-down deals, leverage creative financing, and structure agreements that work for all parties.

How quickly can I start making money with lease options?

Lease options can be set up in a matter of weeks, meaning you could start generating cash flow much faster than traditional property investing. Many investors secure their first lease option deal within 6 weeks after applying the strategies learned at Lease Options Live.

Is there a risk-free guarantee?

Yes! Attend Day 1 of Lease Options Live, and if you decide it’s not for you, simply let us know by the end of the day, and we’ll give you a full refund—no questions asked.

We’re so confident that you’ll gain massive value from this 2-day workshop, we’re offering a bold guarantee:

If at any point up to the end of day one you decide this isn’t the best workshop you’ve attended, just let us know and you’ll receive a full refund. Your attendance is the only condition. You have absolutely nothing to lose and everything to gain!

Meet Your Trainer: Simon Zutshi

Simon Zutshi, is a financially independent, professional property investor, best-selling author and widely recognised as the top wealth creation strategists in the UK. Having started to invest in 1995, he became financially independent by the age of 32.

Passionate about sharing his experience, Simon founded the property investor’s network in 2003 which has grown to become the largest property networking organisation in the UK, with monthly meetings in 50+ cities, designed specifically to provide a supportive, educational and inspirational environment for people like you to network with and learn from other successful investors.

Since 2003 Simon has taught thousands of entrepreneurs and business owners how to successfully invest in a tax efficient way to create additional streams of income, give them more time to do the things they want to do and build their long-term wealth.