A 2-day deep dive into how to consistently raise the capital you need to grow your property investments.

Upcoming Event Dates

Where: Online – Join from Anywhere!

Go to Checkout

Here's What You’ll Learn:

Session 1: Fundamentals of Raising Finance

You’ll learn why securing external funding is so important even if you already have capital. We’ll explore the power of leverage and how to scale your portfolio faster using other people’s money. You’ll also get an overview of different financing models, including traditional loans, private investors, vendor finance, pension funds, and creative deal structures.

Session 2: Defining Your Property Goals and Mindset

Getting clear on your financial goals is the first step to raising the right type of finance. You’ll define your short-term and long-term property goals, ensuring you know exactly how much funding you need and when. We’ll also work on developing a winning mindset one that embraces calculated risk, persistence, and adaptability so you can confidently approach funding opportunities without fear or hesitation.

Session 3: Using Assets You Already Control

Many investors don’t realise they already have valuable assets they can leverage to secure finance. We’ll identify the assets you currently own such as property equity or other investments that can be used as security. You’ll also discover creative ways to unlock capital from underutilised assets and learn how to structure proposals that make lenders feel secure in funding your deals.

Session 4: The Power of Private Lenders

Private lenders are one of the most valuable sources of funding for property investors. You’ll learn who private lenders are, how they operate, and how to position yourself as an attractive investment partner. We’ll cover how to create win-win terms that ensure investors get a great return while keeping your deals highly profitable. Plus, you’ll gain insights into building long-term relationships with private lenders to ensure consistent funding for future projects.

Session 5: Raising Your Profile and Attracting Investment

If you want investors to trust you with their money, you need to establish credibility. This session will show you how to raise your profile as a serious property investor, build your personal brand, and use networking strategies to connect with people who are actively looking to invest. You’ll also learn how to position your track record, case studies, and testimonials to make lenders feel confident in your ability to deliver results.

Session 6: Exploring Alternative Funding Options

Beyond traditional loans and private investors, there are many creative ways to raise finance. We’ll explore strategies such as vendor finance, momentum investing (where profits from one project fund the next), and how to tap into pension funds and business loans. You’ll learn how to assess these options carefully to ensure they align with your investment goals while managing risk effectively.

Session 7: Approaching Potential Lenders and Funding Sources

Confidence is key when approaching potential lenders. This session will teach you how to initiate conversations with potential investors and present opportunities in a way that makes them excited to work with you. You’ll also gain insight into the different funding sources lenders use, from personal savings to investment portfolios, and how to structure your proposals to align with their financial goals.

Session 8: Unlocking Hidden Assets and Managing Private Loans

Many investors overlook hidden assets that could be leveraged for funding. In this session, you’ll discover how to identify these assets, from intellectual property to skill sets that can generate additional capital. We’ll also cover the mechanics of private loans, including repayment structures, legal considerations, and risk management strategies to protect both yourself and your investors.

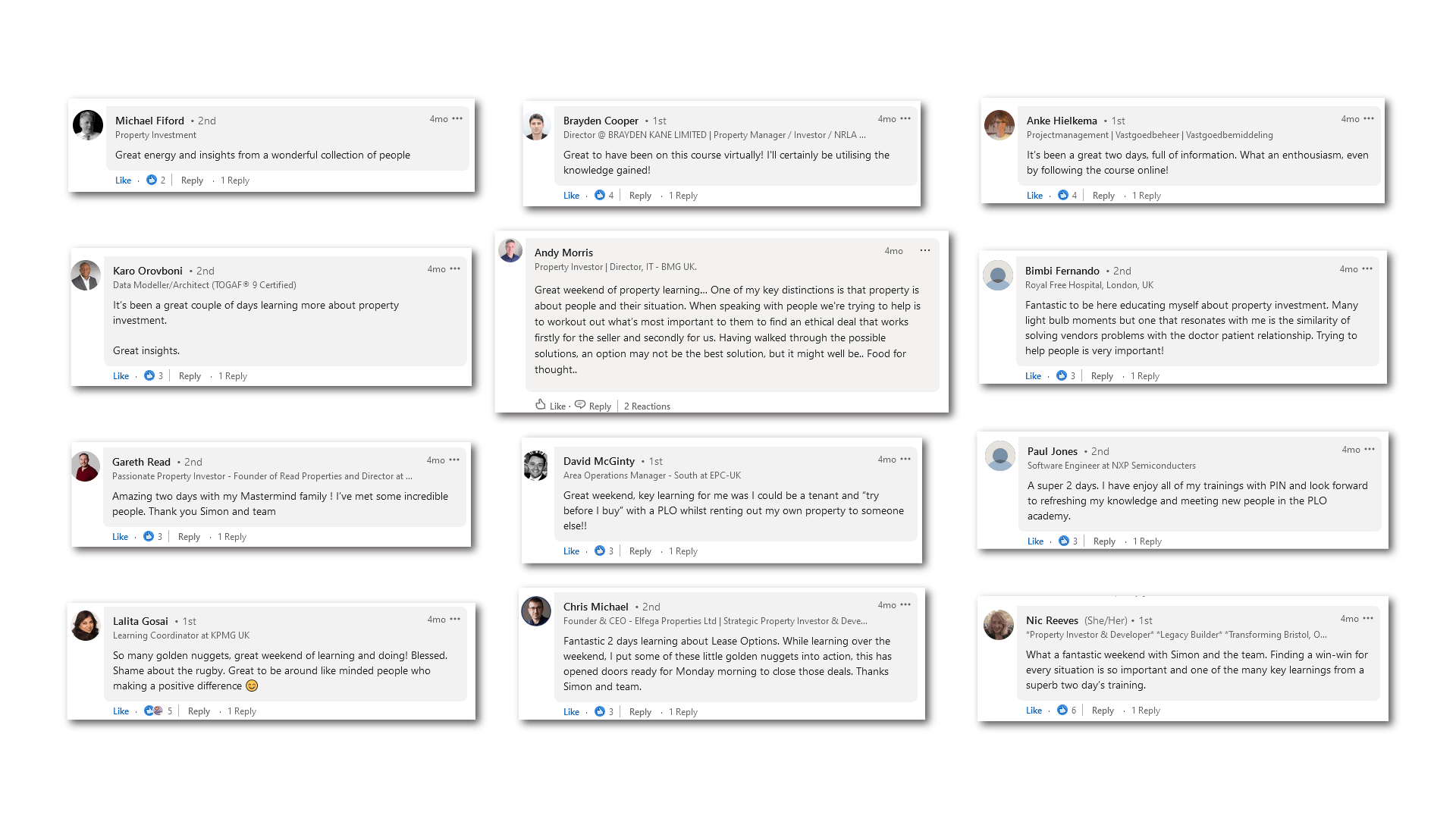

Here's what some of my students have experienced from this workshop...

Frequently asked questions

Do I need to have experience in property investing to attend?

No! This event is designed for both new and experienced investors. If you’re just starting, you’ll learn the fundamentals of raising finance. If you already have some experience, you’ll discover advanced strategies to scale your portfolio faster.

What if I don’t have a track record yet?

You don’t need years of experience to raise finance. What matters most is your ability to structure opportunities and present them confidently. This training will teach you how to build credibility and attract investors even if you’re just getting started.

Is it possible to raise finance without putting my own money in?

Yes! Many investors use creative strategies such as vendor finance, private lending, and joint ventures to secure funding without personal capital. You’ll learn exactly how to structure these deals during the event.

How do I find private investors willing to fund my deals?

We’ll cover multiple methods, including networking, online platforms, and leveraging your existing contacts. You may already know people willing to invest—you just need the right approach to get them on board.

What if I’m nervous about asking people for money?

That’s completely normal! This event will help you develop the confidence and clarity needed to approach investors with ease. You’ll learn how to present deals in a way that makes lenders feel secure and excited about working with you.

What if I don’t find value in the event?

We offer a 100% Risk-Free Money-Back Guarantee. If by the end of the first day you feel Raising Finance Live isn’t for you, simply return the course materials, and we’ll refund your ticket price in full, subject to attendance.

We’re so confident that you’ll gain massive value from this 2-day workshop, we’re offering a bold guarantee:

If at any point up to the end of day one you decide this isn’t the best workshop you’ve attended, just let us know and you’ll receive a full refund. Your attendance is the only condition. You have absolutely nothing to lose and everything to gain!

Meet Your Trainer: Simon Zutshi

Simon Zutshi, is a financially independent, professional property investor, best-selling author and widely recognised as the top wealth creation strategists in the UK. Having started to invest in 1995, he became financially independent by the age of 32.

Passionate about sharing his experience, Simon founded the property investor’s network in 2003 which has grown to become the largest property networking organisation in the UK, with monthly meetings in 50+ cities, designed specifically to provide a supportive, educational and inspirational environment for people like you to network with and learn from other successful investors.

Since 2003 Simon has taught thousands of entrepreneurs and business owners how to successfully invest in a tax efficient way to create additional streams of income, give them more time to do the things they want to do and build their long-term wealth.